Two Bronx electeds have submitted different plans for increasing property tax relief for the city’s homeowners and renters.

In February, Senator Jeff Klein and Councilman James Vacca will both be presenting different proposals to reduce the tax burden on the middle class.

Klein, leader of the Independent Democratic Conference, intends to provide this relief through his three yet to be revealed proposals – by factoring in an individual or families’ city PIT, or Personal Income Tax, by increasing the maximum benefit to city renters and by increasing the percent of annual rent that is attributed to property taxes to up to 20%.

Under Klein’s plan, more than 375,000 additional New York City residents would likely benefit than under the governor’s proposal.

His IDC plan also seeks to create equality among renters and homeowners, with the maximum benefit being increased from $750 to $2000, while also increasing the percent of annual rent that is attributed to property taxes to 20% – which will meet the general standard of housing affordability.

Currently, a tenant would have to pay more than 30% of their income in rent to qualify.

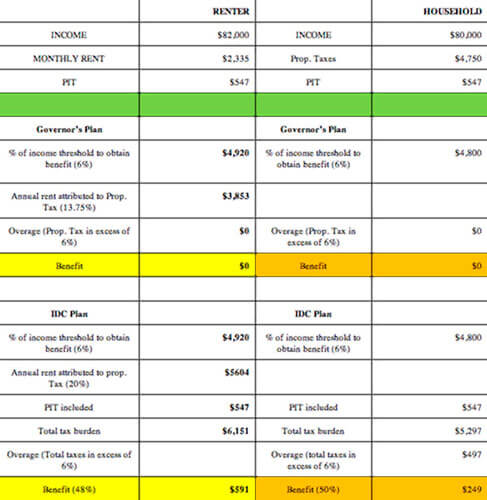

For example, under Klein’s plan, a renter in New York City earning $82,000 annually and spending $2,300 per month on rent will see a benefit of $600, whereas under the governor’s plan, the renter would not receive any benefit.

Also, a homeowner making $80,000 annually and spending $4,700 on property taxes would receive a benefit of $250. Homeowners would not qualify for this benefit under the governor’s plan.

“New York City, unlike other areas throughout the state, has a more diverse tax mix but draws from a broader range of other taxes to pay for local services,” said Klein. “We need to provide relief for more New York City households in a way that reflects the reality of what they are paying for a roof over their heads.”

“This plan puts more money back in the pockets of renters and homeowners with a sensible, realistic approach tailored to the real needs of those who live in New York City, creating a more level playing field between the renters and homeowners of NYC,” Klein said.

Vacca’s approach to relieve property taxes, which is not yet official, is slightly different.

Currently, Vacca is urging the community to check the annual roll of tentative property values, which was recently released by the NYC Department of Finance. As part of his plan, he strongly suggested that if owners believe the value or description of their property is incorrect, that they should challenge the assessment with the NYC Tax Commission and Department of Finance.

Vacca also informed the community about the Department of Finance’s outreach sessions, which educated the community on these issues and the proper precautions to take to avoid being a victim of paying high taxes as a homeowner or a renter.

“We are now in the process of, and very close to finding a resolution for this boroughwide and citywide situation,” a spokesperson from Vacca’s office said.

“We plan for property owners to test these rebates and we are also in official correspondence with the mayor’s and speaker’s offices about this proposal.”