Students across the country are returning to school, some in-person for the first time since the pandemic began. While many underserved Black and Latinx students struggled with systematic educational inequities before the pandemic, Covid-19 magnified many of these inequalities and brought them into greater focus. A recent McKinsey study showed that as a result of the pandemic, students of color were about three to five months behind in learning, compared to the one to three months by white students. Now more than ever, education is needed for youth on technology and business education.

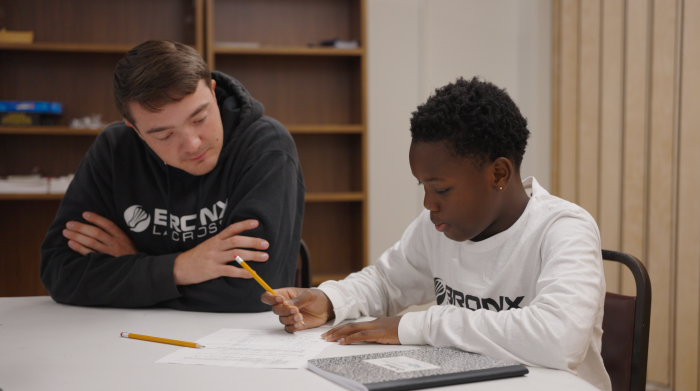

World of Money, a non-profit organization founded in 2015, seeks to empower children and youth with resources to improve their financial education and achieve greater economic security and mobility. We connect youth and their parents with financial experts to equip them to learn, earn, save, invest and donate responsibly. Since its inception, more than 5,000 youth between ages 7-18, and their families have received World of Money’s annual 120 classroom hours of financial education, youth business pitch competitions and parent forums.

But we can’t do this alone. To ensure all Americans have access to financial education, access to financial services is critical. We can teach about responsible use of the financial system in a classroom and online, but if policymakers limit their access in the real world then it is all for naught.

It is essential that Congress addresses financial policy through the lens of those most impacted by the pandemic. While efforts like stimulus payments have helped to blunt the damage, lawmakers are simultaneously reigniting conversations on policies that would limit access to financial products and services.

Specifically, proposals imposing onerous routing mandates on credit cards would create serious damage to the long-term financial success of Black and Latinx families. On the surface, this might seem contradictory. However, previous efforts to impose limits on debit cards in 2010 resulted in a significant increase in unbanked Americans and harm to low-income communities. These families were particularly impacted by the consequences of the debit card cap, especially the loss of debit rewards, more stringent balance requirements, and higher fees — with some exiting the traditional banking system as a result. So, while lawmakers think that they would be helping consumers, the reality is that they would actually be cutting them off from the very financial tools and services that we teach every day.

Additionally, without access to mainstream financial services, families will lose access to tools like fraud protection, while having less access to capital. A recent Federal Reserve report found that in the wake of the previous debit processing limits, more than 20 million Black and Latino Americans were forced to seek alternative financial services. Without access to reasonable mortgages, families are unable to access broader financial growth and basic housing security. Without business loans, a small business can’t expand or invest in new equipment. Access to equity and credit through traditional banking channels is associated with reducing income inequality, improving mental health, and empowering women.

Even before the pandemic, it was unbearably expensive to live without access to traditional banking and financial products and services. In 2021, the Financial Health Network released a market study that found the unbanked and underbanked populations spent $255 billion in fees and interest over the course of 2020. Beyond the monetary costs, there are social impacts that are more difficult to measure but have shown to have significant impact on individuals and youth. The Consumer Financial Protection Bureau conducted a review of youth financial education studies in 2019 and found, among the effects of youth education programs, “financial education improves credit scores and decreases delinquency rates.”

Now more than ever, the pandemic demonstrates that access to internet, electronic payments, credit cards, and basic financial services are not just a “nice to have” lesson in a classroom but an essential part of bridging the financial equity gap. Empowering youth with the knowledge and confidence to make conscious financial decisions from an earlier age promotes access to affordable financial services and a reduction in underbanked Americans, expanding opportunities economically and beyond. Combining that financial education with the real-life access to these financial tools is a pathway for long-term success for American youth.

Sabrina Lamb, is the founder and CEO of World of Money, a New York-based non-profit organization.