Building financial literacy in underserved communities is critical to addressing inequality throughout the city. Due to systemic educational inequities, underserved Black and Latino students throughout New York City do not have the resources they need to be successful. Paired with the fact that predatory financial services are predominantly headquartered in Black and Latino communities, these communities are especially vulnerable to misinformation and fraud.

If we are serious about creating a better future for the next generation, we need to empower youth with the knowledge and confidence to make conscious financial decisions from an early age. Internet access, electronic payments, credit cards and basic financial services are not just a “nice to have” lesson in a classroom, but an essential part of bridging the financial equity gap.

Because communities of color lack access to mainstream financial services, they are forced to seek pay-day loans or utilize the local check-cashing business as a substitute for traditional banking services, without a full understanding of the laws that serve to protect them. Promoting financial literacy in these areas would minimize their vulnerability against predatory lending. Access to equity and credit through traditional banking channels is associated with reducing income inequality, improving mental health, and empowering women.

I have always known the value of a strong work ethic. From a young age, I watched my father build his business and advance his career right here in The Bronx. I want to ensure that such a future is possible for everyone – without systemic roadblocks.

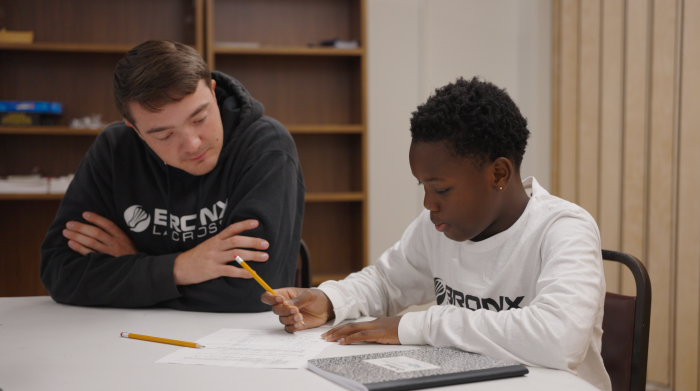

In the absence of financial literacy courses being integrated into the academic classroom, organizations like WorldofMoney step up to the plate to equip young people to invest in their futures in real ways. The workshops I have hosted with WorldofMoney seek to empower youth through financial education, creating a pathway for underserved communities. By empowering children and youth with the resources needed to improve their economic security and mobility, young people can be better equipped to embark on their futures with the knowledge to learn, earn, save, invest and donate responsibly.

But we can’t rely on the goodwill of organizations alone. The state must invest in future generations by providing a pathway for them to achieve success regardless of their economic background. Incorporating financial literacy education into our school curriculums will be the first step in ensuring that this is possible.

As costs of living and economic inequality increase exponentially, it is more important than ever that young New Yorkers have the education they need to responsibly plan for the future. Throughout the state we must empower youth with the knowledge and confidence to make conscious financial decisions at an earlier age. I’m committed to making sure that all students have the tools to achieve financial well-being for many generations to come.

Nathalia Fernández is a member of the New York State Assembly representing the Bronx’s 80th District.